KARL's BLOG

An Independent Voice on American Life

KARL's BLOG

An Independent Voice on American Life

KARL's BLOG

An Independent Voice on American Life

National Debt updated

Debt $18,603,378,000,000 as of 11/11/2015 at 1300 hours and counting. It goes up so fast I must include the time.

National Debt

The National Debt now stands at 13.5 trillion and growing. Thats over 43 thousand for every US citizen. (if we can document a few million guest workers we might reduce it a fraction). Makes you proud doesn't it. It should make you down right scared. The national deficit is over a trillion. How can we keep spending money we do not have?? This November, tell the folks in Washington to stop spending by voting someone else into office.

As of 10/01/2010 the National Debt stands at: $13,569,269,432,587.88

The estimated population of the United States is 309,214,695. So each citizen's share of this debt is $43,573.92. The National Debt has continued to increase an average of $4.06 billion per day since September 28, 2007!

See the Debt clock @ http://www.usdebtclock.org/

This insanity is unsustainable. The National Deficit $1,359,413,000,000.00. The deficit is now bigger than the debt was at the beginning of the Reagon years. President Bush and the war did a job on the National Deficit, doubling it, but now the deficit is almost 3 times what it was under Bush. Obama is out of control. His administration will surely bankrupt this country if it continues. And Obama has just started...I believe his plan is to bankrupt the country so we have no choice but to completely rely on the government for help. Then he and his cronies will get the United States of America they can be proud of.

What’s an investor to do?

When asked whether to invest in the Stock Market, some say invest now, some say sell, and others say they don’t invest in the stock market. If your retirement plan is a 401K, 403b, or some sort of IRA through your employers you are most likely invested in the stock market. Some have all their assets in a small business or real estate which might really be difficult in these times.

It doesn't appear the average Joe can’t invest with any confidence these days. Fear has over taken them (including myself) and they go into cash. Cash accounts can be problematic. While they prevent the big losses, the investor also loses out on big rallies that offset the downhill side. Investors that do not invest in the market, or don’t realize they are invested, sit back with ease expecting everything to be OK. Every mutual fund, 401K, or even bond portfolio is invested in the stock market. When opening their statement they get nervous.

Placing stops on your portfolio is the best way to prevent a huge loss. However, you also need to know when to get back in. And there lies the problem. A short rally might appear to be a great buy signal and then it turns sour. Miss out on the buy signal and risk a big rally that might offset the loss from the last downturn.

These days analysts down grade a stock and the stock tanks. Often times it returns to its high within a month or so because the analyst is an IDIOT. I often wonder whether the analyst is in the pocket of big investors and down grade as their boss shorts the stock. Remember Goldman Sachs selling their clients mortgage backed securities when Goldman Sachs was actually shorting the market. Does the work crook come to mind? Certainly ethics should come to mind.

Here is some information gleaned from the internet.

From Wealth Insider Alliance

“Every Mini-Crash, Dip and Collapse puts you further and further behind financially.

If you have $10,000 and lose 50%, how big of a gain do you need to get your $10,000 back? Right: 100% gain. You need to make a 100% gain to recover from a 50% loss.

Think about it: A 50% loss on $10,000 is $5,000, but a 50% GAIN on $5,000 is only $2,500. In order to regain your original $10,000, you need a 100% gain on $5,000.

The more you lose, the harder it is to get back to even…

• If you lose 25% in a downturn – you need to GAIN 33% just to break even

If you lose 25% in a downturn – you need to GAIN 33% just to break even

• If you lose 33% in a downturn – you need to GAIN 50% just to break even

If you lose 33% in a downturn – you need to GAIN 50% just to break even

• If you lose 50% in a downturn – you need to GAIN 100% just to break even “

If you lose 50% in a downturn – you need to GAIN 100% just to break even “

Below are some charts of the Dow Jones Industrial Average. The last ten years has been a roller coaster. What does the future bring? Ultimately the DJIA will rise. See the next chart. The big question is how long do you have before retirement? Can you wait for a return to consistent growth?

From Wealth Insider Alliance

“Robin Griffiths is a technical strategist. I don't know the man personally, but I agree with much of what he says in this video. (see video at right)

He states, "One of the reasons [for the surge in the stock market] is POMO: what happens is the Fed buys Treasuries off the banks, the banks put the money into the market...That amount of money turns the algorithms up, then all the algo trading hits the market. Real life investment managers are not doing this buying. They know that equities are for losers." He continues, "The S&P is being effectively goosed up by the Plunge Protection Team - they can keep doing this for a little bit longer... But according to me the April high will not break...as...all of those Keynesian stimuli did not work."

POMO stands for Permanent Open Market Operations of the Fed. The New York Fed describe it as, "The purchase or sale of Treasury securities on an outright basis adds or drains reserves available in the banking system."

Last week I informed you that the Fed had purchased $22 billion, in effect adding that much to the "banking system."

Everyone assumes, and the media encourages the assumption, that the Fed can just keep creating money out of thin air and elevate the stock market indefinitely. I do not hold that opinion, and neither does the guest in today's video. “

Unfortunately, if Economist can't even agree, I certainly do not have the answers for you. I am usually bullish and optimistic. These past few years has made me pessimistic and bearish. The best you can do is at least educate yourself so you can make a good personal choice. That choice may simply be to let it ride. And by looking at the DJIA lifetime it seems to work out. Unless you started investing in 2000. You started with the DJIA at 10,000 and it is still at 10,000. 10 years of nothing.

School District Salaries

I am writing this blog due to the recent squawk about school administrators in Coos Bay getting a pay raise. This prompted me to research wages for school administrators and teachers. Not all school district information is readily available so I went with some Portland area information. Here are the results.

Example Hillsboro School District with 20,700 students and 24 Administrators ranging in pay from $83,000-$175,000.

The Superintendent makes $147,400 in Tigard-Tualatin, $175,000 in Hillsboro, and $194,000 in Beaverton.

Hillsboro Assistant Superintendent makes $126,000.

Executive Director of Instruction makes $121,600

Average Principal salary in Oregon is 95,000. Salaries range from $55,000-$110,000.

Teachers make $54,000 for 191 days. Or $6,000/month. That would be $72,000 for 12 months. Most teachers spread their 9 month salary over 12 months giving them a lower monthly salary of $4,500/month.

Administrators work 261 (5 days/week, 12 months annually) Salaries $105,000-$148,600.

A comparison of Public School salary to a Private Company

Hillsboro Superintendent makes $175,000 a year to oversee about 2,000 employees, 20,700 students and a total budget of about $262 million. He works 50 to 60 hours a week. His responsibilities are similar to the chief executive officer of a corporation. In Hillsboro, TriQuint Semiconductor is the closest in size to the school district in terms of employees -- 2,600 worldwide. CEO salary was $413,100 last year, not including other compensation. The company earned $654 million in 2009.

The big difference between the two is one entity makes money and the other burns tax dollars. A noble profession, yes, but one that can only run if companies like TriQuint pay taxes.

According to a survey of public schools conducted by Educational Research Service, average salaries for principals and assistant principals in the 2007-2008 school year were as follows:

Principal $85,907-$97,486, Assistant Principal $71,192-$79,391.

Median annual wages of kindergarten, elementary, middle, and secondary school teachers ranged from $47,100 to $51,180 in May 2008; the lowest 10 percent earned $30,970 to $34,280; the top 10 percent earned $75,190 to $80,970.

According to the American Federation of Teachers, beginning teachers with a bachelor's degree earned an average of $33,227 in the 2005-2006 school year.

At $48,330*, Oregon was ranked 15th in the nation for average teacher salaries in 2005.

Oregon Teachers earn $48,460 and 140% of the average Oregon wage and get 15 weeks of vacation

Every school district varies in salary and rural areas pay less than big districts. However, school teachers and administrators also get great healthcare benefits that most private sector employees can only dream about. Once a teacher is tenured, it is difficult to terminate them, unlike the private sector. I don’t think that teachers have a lot of room to complain considering the salary of many other private sector workers. If you make less than $15.00 per hour then you know what I am talking about. There are a lot of private sector master degree’s looking for work right now and not all masters degrees pull down $50-$100,000 per year. I know of people with master degrees that work for less than $15.00 per hour.

Bottom Line

Education is one area of government spending that most agree is important and must continue no matter what happens. However, there is waste in every branch of government, education included. I hope to review school budgets in the future. While starting teacher salaries are not great, they are not in poverty either. I know of people that work a lot harder for a lot less money. I will give credit for the education teachers have pursued but that was the requirement for the vocation they chose. Most agree that teachers are sheltered from the reality like industries that must turn a profit or die. While putting up with our children every day does deserve some consideration, this blogger doesn’t believe that most school district employees have a strong argument for being undervalued or underpaid.

New Taxes from Obama's Healthcare Bill

Yes, you asked for it. More taxes. If you voted for OBAMA you must be delighted that more taxes are coming down the pike. How about 3.8% tax when you sell your home. If you do not have healthcare coverage because you can't afford it, you will pay 2.5% income tax. Oh ya, tanning will also cost more. It just gets better.

Also on the table are several taxes aimed at encouraging healthier behavior. The committee is proposing to increase the tax on alcohol, and eliminate the current tax variances between beer, wine and alcohol. The committee also proposed levying the first federal tax on sugary beverages. That would apply to soft drinks, fruit and vegetable drinks, energy and sports drinks, iced teas, iced coffees and flavored milk and dairy drinks.

A side note: Before you start thinking that Pharmaceutical Companies, Medical Manufacturers, and other businesses should pay their rightful share of taxes, remember economics 101, the cost will be passed along to the consumer, you and I. So really, the little guy will pay the tax.

Below are 16 new taxes that the Obama administration are pushing through to pay for OBAMACARE.

Bill: HR 3590 Patient Protection Affordable Care Act

3.8% above capital gains on profit from Sale of Home

Bill: H.R. 3590 Patient Protection and Affordable Care Act

Description: A 40% tax on health insurance plans exceeding determined levels. Those levels are projected for 2013 to be $8,500 for self only and $23,000 for any other level.

Bill: H.R. 3590 Patient Protection and Affordable Care Act

Description: An increase from 10% to 20% on taxes of money in a health savings account not used for qualified medical expenses. For Archer medical savings accounts, an increase from 15% to 20%.

Bill: H.R. 3590 Patient Protection and Affordable Care Act

Description: A $50,000 tax on hospital organizations, which fail to meet described quality requirements.

Bill: H.R. 3590 Patient Protection and Affordable Care Act

Status: Awaiting President's signature

Description: A fee based upon the sales of pharmaceutical companies in relation to the total sale of such pharmaceutical products to the public.

Bill: H.R. 3590 Patient Protection and Affordable Care Act

Description: Medical device manufacturers must pay a fee in relation to the sales of their product in the marketplace and the total sales of devices.

Bill: H.R. 3590 Patient Protection and Affordable Care Act

Description: A fee applied to all health insurance providers based upon net premiums and any third party fees associated with the administration of those programs.

Bill: H.R. 3590 Patient Protection and Affordable Care Act

Description: High income tax payers, making on a joint return over $250,000 and a standard return over $200,000, are required to pay an additional 0.5% of wages. This applies to both self-employed, and regularly employed individuals.

Bill: H.R. 3590 Patient Protection and Affordable Care Act

Description: A tax of 5% is levied upon the amount paid for any cosmetic surgery. This does not include the need for such surgeries created by trauma or a disfiguring disease. If the tax is not collected by that professional completing the procedure, their business is still liable for the requirement.

Bill: H.R. 4872 Reconciliation Act

Description: A 2.5% income tax on individuals who do not have health care coverage, limited to a cost less than the average national health care premium.

Bill: H.R. 4872 Reconciliation Act

Description: For self-insured plans, a fee on the the sponsor whether that is the employer or the employee organization. Also, a fee on the issuer of every health care plan imposed.

Bill: H.R. 4872 Reconciliation Act

Description: For firms refusing to pay health insurance, but not meeting required exclusions, an 8% tax on wages will be applied.

Bill: H.R. 3590 Patient Protection and Affordable Care Act

Description: A tax of 10% on the amount paid for any tanning service.

Bill: H.R. 4872 Reconciliation Act

Description: A 1% tax increase for individuals making between $350,000 and $500,000.

Bill: H.R. 4872 Reconciliation Act

Description: A 1.5% tax increase for individuals making between $500,000 and $1 million.

Bill: H.R. 4872 Reconciliation Act

Description: A 5.4% increase for individuals making more than $1 million.

http://www.businessinsider.com/healthcare-bill-new-taxes-2010-3#excise-tax-on-high-cost-employer-sponsored-health-coverage-1

http://online.wsj.com/article/SB124269065234932563.html

http://www.businessinsider.com/whats-wrong-with-the-healthcare-system2010-3#america-spends-7290-per-capita-on-health-care-far-more-than-other-countries-1

United States Budget and Spending

Below is a breakdown of National spending. The website below illustrates the problems we face as a country.

Great Website: http://www.federalbudget.com/

Americans and our Social Programs

Social programs are not free, someone must pay for them. The question is who should pay for them. The government? For the record, the government does not have money nor does it earn money. Uncle Sam confiscates money through taxes. So, who should pay? Business or individuals? Wealthy or Middle Class? The poor are out of the question but should they get a free pass? Having said that, most Americans want prosperity for all.

The big question is can Americans have it all? The simple answer is no. Of course having it all requires further definition. To me having it all means having individual prosperity while providing for societal health, safety, and financial security. Individual prosperity is very subjective as is public welfare. Most Americans, even our poorest, have a much higher standard of living than many countries and certainly most third world countries. Having said that, there remains a segment of society that fall through the cracks and even basic subsistence is not readily available. For the purpose of this blog, I will focus on what most Americans consider the basic requirements for life, liberty, and the pursuit of healthcare.

Having it all requires that all Americans have healthcare, employment, a home, disposable income, and retirement. Is this really possible? Let’s look at healthcare. Many Americans look to Europe for an example of healthcare. Socialized medicine might benefit all but it is not free. Countries like Germany provide healthcare to all through taxes. Most Americans don’t like paying taxes and think someone else should pay more (the wealthy) so they can have services for free. Many Americans think business should pay the lion’s share of taxes, again so they as individuals do not have to pay. Let’s look at taxes around the world.

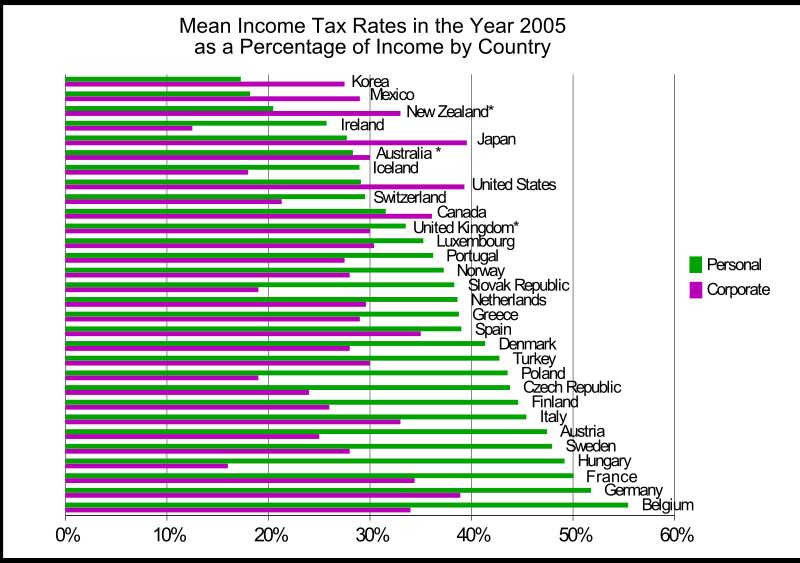

The graph illustrates how low U.S. individual (personal) taxes are compared to our European counterparts. While Americans personal taxes run about 28%, Germans pay well over 50%. Business in Germany pays almost as much American business. The point to take home is that American business’s still pay more than German business’s, so the burden of social programs fall on individuals through personal taxes.

Until Americans are ready to pony up and pay their fair share of taxes Americans will not have all the social programs that so many think we have a “Right” to have for FREE.

Stay tuned for more on American taxes and our social welfare.

Monetizing our Debt

by Karl Logan

11/5/2010

You might have heard the recent news reports about the Federal Reserve using Quantitative Easing and Monetizing the Debt and the resulting inflation.

Inflation: a rise in the cost of goods and services.

Monetization: a process of converting something into legal tender. Printing money.

Quantitative Easing: printing money to buy government debt.

Instead of the Obama Administration controlling spending and creating incentives for business to create jobs, our Federal Reserve has decided to use quantitative easing to try and erase the negative impact of Obama’s policies. Bernanke estimates that the fed will need to print 3-7 trillion dollars to support the economy.

So far the Fed has printed over 2 trillion dollars to buy U.S. debt. As one journalist put it, the government is robbing Peter to pay Peter. Why is our own government buying our debt? Because no one else will buy it. Certainly not for 2% interest. U.S. Debt is now like junk bonds. Junk bonds fetch as high as 20%. Do the math. The U.S. would go broke if we paid 20% on our debt.

So, Obama’s solution is to print money. In turn, the dollar’s buying power declines, inflations ramps up, and our currency in the world becomes worthless. The U.S. has less buying power. The consumer has less buying power. Your 401K is worth less.

Have you seen gold prices? Gold is at new highs. Are you excited that the stock market is rallying? It is because the Fed keeps buying treasury bonds to support the economy. The Fed buys bonds, the banks in turn buy equities, and the stock market rallies. It is great. No it is not. Obama is printing money to pay for his programs. And while the Fed is supposed to be independent of the government, the Fed is trying to stave off bankruptcy.

The tidal wave of Republicans in the past election is a referendum on the economy, healthcare, and Barack Obama.

http://blog.wallstreetgrand.com/2010/10/to-beat-down-deficit-monetize-the-debtinflation/

http://www.swifteconomics.com/2010/10/31/quantitative-easing/

http://poweroftheindividual.blogspot.com/2010/08/us-to-monetize-debt-inflation-tsunami.html

http://en.wikipedia.org/wiki/Quantitative_easing

Healthcare Reform

by Karl Logan 02/06/2011

As you know, the House passed a repeal of Obamacare and the Senate killed the repeal. There is a lot of hoopla about reform and some true benefits. But what would you like to see in healthcare reform. What is your biggest issue with healthcare? German Healthcare is paid half by employer and half by the employee. In the US many employers pay the majority of the premium. If you think Obamacare is what Americans need...are you willing to pay 10% of your income for it? 15%? 20%?

Congress continues to plod along in an attempt to roll out healthcare reform and at the same time repeal Obamacare, Americans are left with holes in reform and facing a huge tax burden. But what do Americans believe reform should include? I think if the government wants to reform healthcare, they should consider the following bullet points. What do you think? Some of the items listed are covered in one way or another in Obama’s plan. Help me add to the list. What do you think is the top issue that needs reform?

- Transportable polices (an employee can quit a job and go to another without losing coverage)

- Affordable policies (might include higher deductibles)

- No waiting period for preexisting illness

- You buy in for a year (you are obligated to a year purchase broken into installments)

- Require providers to inform the patient if their insurance coverage is reduced at their office, clinic, lab, x-ray facility or MRI.

- Provide an estimate of costs.

- Tort reform

Transportable policies…provide both the employer and employee opportunity. Many employees stay at a job simply due to benefits. If they are great employees, good for the employer. However, it is not always good for the employee. Employees might hate the job and be depressed. This can also result in poor performance from the employee which is not good for the employer. Low productivity and bad morale can negatively impact the workplace.

Affordable policies…are few and far between. Many employer provide great healthcare coverage. The total premiums might be $1000-$1500 per month. While cobra is available for 6 months, an average $1250.00 premium is not affordable with a job let alone when one is unemployed. Converting a policy to an affordable option without loss of coverage, waiting periods, or preexisting clauses are a must.

No waiting periods…are a must. Many people put off coverage for this reason alone. I understand the reasoning. It is easier to capture the premiums up front than the hope of capturing them on the other end when the end might have been corrected. The waiting period might mean an employee must work ill before they can seek medical treatment. If the need is a family member, imagine the depression and anxiety of not being able to provide care.

Policy purchase must have a minimum year term to prevent people from enrolling for a surgery then canceling when they are back on their feet. This is already required in many employer dental plans. If an employee must maintain it for a year, they are more likely to retain the policy beyond the minimum requirement.

Require provider business ethics…that relate to patient insurance coverage. Some providers will bill you as an out of network provider significantly increasing your out-of-pocket expenses just to get the business. This is unethical and happens a lot. I have had an MRI facility do this. They were on the provider list but one of their physicians was not a preferred provider, and their interpretation was billed as an out-of-network provider.

Providing an estimate of costs…will not only enlighten the patient, it will no doubt bring costs down. If patient really knew the cost of a procedure or surgery, they might shop around. At minimum, they would know how much they have to save for their deductable. Some insurance companies already encourage this practice but it is nearly impossible to acquire at true cost. Some insurance companies don’t want consumers shopping around either. This kind of transparency will show which insurance provider really gives the most bang for the buck. Image if a hospital boasted that they charged less on average per stay than the competition. Or if a physician charged the same fee but had better outcomes.

Tort reform…is a must. Holding a physician or hospital accountable for malpractice is one thing, but patients and their lawyers collecting millions of dollars beyond the true cost of real damages is another. Many times a jury feels sorry for the victim and awards outrageous settlements. This act alone drives up healthcare costs for us all. The huge award does get the attention of providers and often results in safety changes. However, the awards should be pared down.

ECONOMICS and MONEY